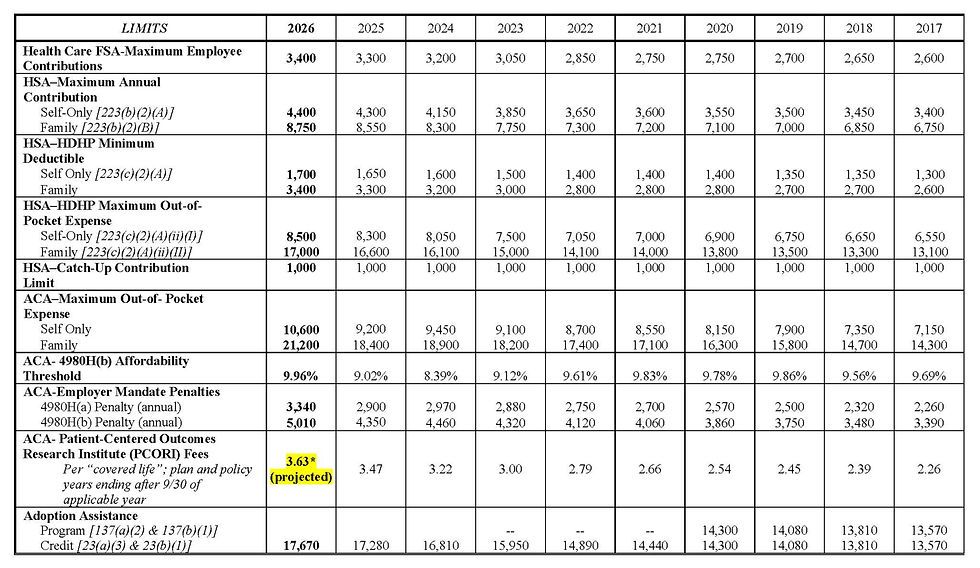

2026 Health and Welfare Benefit Plan Annual Limits

- Boutwell Fay LLP

- Nov 10, 2025

- 1 min read

For 2026, the Health Savings Account (HSA) contribution limit increases to $4,400 for self-only and $8,750 for family coverage, with the 55+ catch-up remaining at $1,000; qualifying HDHP maximum out-of-pocket limits are $8,500 (self) and $17,000 (family). The Health FSA contribution limit rises to $3,400, with a maximum carryover of $680. Notably, the Dependent Care FSA limit increases to $7,500 (joint filers) and $3,750 (married filing separately).

Download the 2026 Health and Welfare Benefit Plan Annual Limits

© Boutwell Fay LLP 2025, All Rights Reserved. This handout is for information purposes only and may constitute attorney advertising. It should not be construed as legal advice and does not create an attorney-client relationship. If you have questions or would like our advice with respect to any of this information, please contact us. The information contained in this article is effective as of October 2025.

Comments